Trading Stock Options Allowed Me to Retire from Corporate America When I Was 34…

My wife and I achieved financial freedom in only five years with high savings plus trading stock options. Note: we eliminated all consumer debt before we embarked on the journey.

The plan we followed is hard to achieve but simple in concept.

You start with a $10,000 account, grow it by 60% a year, and in five years, you’ll have a six-figure account. Since we were out of debt and had no kids then, the $2,000 - $5,000 we earned from trading stock options was enough for us to live on.

Note: in the beginning stages, most of the 60% growth came from the monthly money we added to the account. We lived on my $30,000 a year salary and saved/invested my wife’s $50,000 yearly salary. That, along with the 15% - 30% we were earning in options performance, caused our net worth to explode.

Yes, I’m aware that it’s a dream come true. It’s almost too good to be true. It’s my life, I live it, and even I have a hard time believing we did it. However, before I get too far ahead, let me explain options trading so you can understand why we earned such high investment returns.

Trading stock options is a relatively unknown form of stock market investing, but it’s essentially the buying and selling of options contracts.

An options contract is an agreement between two parties regarding buying or selling a stock.

It’s a highly flexible tool that helps you make money in any market environment. They can also be used to:

- Generate monthly income...

- Insure or protect the value of your portfolio...

- Or earn higher returns than traditional buy-and-hold...

HOWEVER, options can be risky and cause massive losses when you don’t know what you’re doing. That’s why it’s essential to be thoroughly educated before attempting real money trading.

Leverage is why Trading Stock Options is so profitable…

Stock options are leveraged. It’s what makes them so profitable. I’ll cover a fictitious example and then will show you an actual real trade I made.

- One stock option contract controls 100 shares of stock.

- I could invest $5,000 to buy 100 shares of stock XYZ at $50 a share.

- Or, for a fraction of the cost, I could buy the December 2022 50 Call option on stock XYZ for $5 (Calls will be explained in another lesson).

If stock XYZ goes up $5 (50 to 55), that option contract may also go up $5 (a 100% return on my investment). Remember, the Option controls the shares and benefits from the movement of the stock. The “contract” controls the large asset, but I only have to pay a small sum for the contract.

At this point, I sell my contract back into the market and pocket my 100% ROI. This is a 100% return on my investment, not my account size.

So that’s leverage. A small investment can allow you to control and benefit from a large asset.

It’s similar to putting 20% down on a $300,000 house you want to buy. Your only investment was 20% of the cost ($60,000); the rest you financed. However, you still benefit from the total price appreciation of a $300,000 house. So if the house increases 10% in value to $330,000, you have a 50% return on your $60K investment.

As options traders, this is what we do; we place small bets to control large assets (stocks). And when those stocks increase or decrease in value, we generate returns of 50% or more.

And yes, you read that correctly. We can make money even when the asset falls in price. That is what we will cover in the following example.

An Example of Trading Stock Options During a Bear Market...

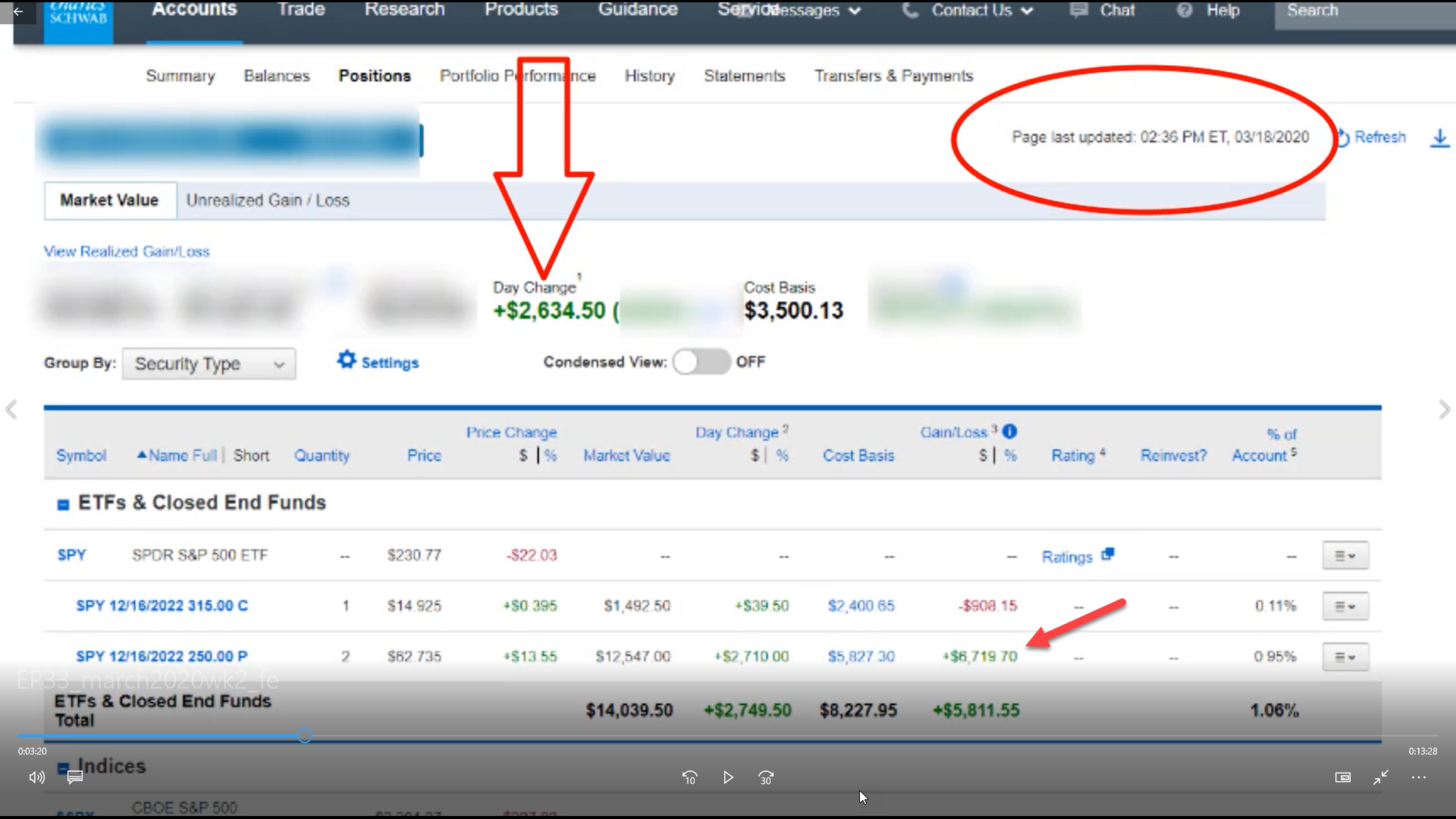

The picture below shows my mom’s investment account on 3-18-2020, in the middle of a short but violent Bear Market.

Summary of the picture: I bought insurance for my Mom’s account, and the profit from that insurance offset what she lost on her stock shares. Thus, she didn’t lose any money during the Bear Market.

More specifically, I bought two December 2022 Put options with a $250 strike price. In another lesson, we’ll cover the definition of strike price and Put options, but Puts were initially created as a form of insurance for buy-and-hold investors.

For a small investment of $5,827.30, I could control and benefit from the movement of $50,000 worth of stock. Said another way, I bought insurance for $50,000 worth of stock, which only cost a few thousand dollars.

If you recall from an earlier lesson, a stock option contract gives the owner the right (or option) to buy or sell a stock at an agreed-upon price and an agreed-upon date.

Call options lock in a buy price for the stock, and Put options lock in a sales price.

- You buy Calls when you think the stock will go up.

- You buy Puts when you believe the stock will fall in price.

Even if the stock fell in price to $10, those Put options would guarantee my mom could sell her stock at the agreed-upon price of $250. The farther the stock fell in price, the more valuable those contracts would be. Think about it, If the stock was trading for $10 and you owned and contract that said you could sell it for $250 wouldn’t people who bought the stock at a higher price want that contract?

Have you ever lost so much money on a stock that you hope and pray it returns to your purchase price so you can get out at breakeven? Well, these Put options provide that guarantee, as long as the contract is valid. Options contracts have expiration dates, so you must use or trade them before they expire.

And when you’re trading stock options, you don’t use the “rights” to “buy or sell” the stock that the contract gives you. You instead trade the contract. Meaning you sell it back into the Options market and pocket your profit.

In this case, I would sell my two Put options and pocket the $6,719.70 profit or a 115% return on my investment of $5,827.30. If I had $60,000 in my investment account, the profit on the Puts would grow my ENTIRE account by 11%.

So a 100% return on the trade, but only an 11% return on my account size. Think about how many of these I need to get the 15% - 30% account returns I discussed earlier. I hope this helps you see how we achieved Financial Freedom quickly and how trading stock options (buying and selling contracts) can be profitable.

If you’re ready to learn more, check out the free options trading course links below.

The Passive Stock Options Trading Book Series

Discover how to achieve financial freedom in only 5 years...

Read what others have to say about the book. [Amazon affiliate link]

If You're Looking For A Reliable Lower Risk Way To Be

Profitable With Options, Try The "Buffett Strategy"...

I don't know what has brought you to my page. Maybe you are interested in options to help you reduce the risk of your other stock market holdings.

Maybe you are looking for a way to generate a little additional income for retirement. Or maybe you've just heard about options, you're not sure what they are, and you want a simple step-by-step guide to understanding them and getting started with them.

I have no idea if options are even right for you, but I do promise to show you what has worked for me and the exact steps I've taken to use them to earn additional income, protect my investments, and to experience freedom in my life.

If you want to learn more, I invite you to download a FREE video case study on how to trade options like Warren Buffett.

Inside you will discover...

- How investors pay me money to buy their stock.

- How "combining option selling with option buying" resulted in a 60% growth of my account.

- The "Family Freedom Fund" strategy I use to beat the market each year (I'm an experienced investor so your results may vary).

- And lastly, there is a high risk way to trade options and a low risk way. You'll discover a low risk "sleep well at night" method of investing.

Fill in your details below to download your FREE case study. Along with your case study, you'll also get my daily emails where I share my favorite option trading strategies, examples of the trades I'm currently in, and ways to protect your investments in any market.

Wealth Building Resources

Free Video Case Study (Newsletter)

Options Trading Made Simple Book (My Kindle book)

Options Wealth Academy (High End Training Program co-founded by Travis)

Free Options Course Learning Modules

|

Module 1: Option Basics |

Module 2: Option Value |

Module 3: Basic Strategies |

|

Module 4: Stock Charts |

Module 5: Technical Indicators |

Module 6: The 7-step process I use to trade stock options |

Learn Stock Options Trading Home Page